basis cryptocurrency value

The tax perk makes the cost basis 64000 which means you. Cryptocurrency Regulations in the United States.

Behind Bitcoin A Closer Look At The Tax Implications Of Cryptocurrency Poole Thought Leadership

What Is Bitcoin BTC.

. Past performance is not indicative of future results. Legal regulation varies by state While it is difficult to find a consistent legal approach at state level the US continues to make progress in developing federal-level cryptocurrency legislation. Cryptocurrency is a digital asset that uses blockchain technology to assign ownership to each unit.

Past performance is not indicative of future results. The Financial Crimes Enforcement Network FinCEN does not consider. You will be able to deduct the value of your cryptocurrency at fair market value.

Any investment in blockchain assets involves the risk of loss of part or all of your investment. Under the special rules the starting point for basis is the lower of. The amount of the gift is its value for gift tax purposes after reduction by any annual.

Cryptocurrency is a good investment if you want to gain direct exposure to the demand for digital currency while a safer but potentially less lucrative alternative is to buy the stocks of. The cost basis for Litecoin would be the fair market value of the Bitcoin at the time of sale in US. No - CRYPTO20 is not a platform.

XMOON Price Live Data. For appreciated assets those with date-of-death fair market value in excess of the decedents basis a limited basis step-up rule can be used at the discretion of the estates executor. If you give cryptocurrency as a gift to someone other than your spouse or civil partner you will have to figure out the market value in pound sterling.

1 the assets fair market value on the date of death or 2 the decedents basis. Cryptocurrency is a high-risk investment because its a volatile asset and investors should buy with caution. RCryptoCurrency Moons is down 130 in the last 24 hours.

The partners basis must be determined using the basis rules described in Publication 551. Similarly blockchain assets you exchange on the basis of your research may increase in value after your exchange. Get our exclusive e-book which will guide you through the step-by-step process to get started with making money via Cryptocurrency investments.

Cryptocurrency investors can buy or sell them directly in a spot market or they can invest indirectly in a futures market or by using investment products that provide. We update our xMOON to USD price in real-time. ARK believes cryptocurrencies governed by open source networks are enabling a new paradigm for monetary systems and mechanisms to store and transfer value.

If you receive cryptocurrency from an airdrop following a hard fork your basis in that cryptocurrency is equal to the amount you included in income on your Federal income tax return. Enroll in our Free Cryptocurrency Webinar now to learn everything you need to know about crypto investing. About the author Kiana Danial Kiana Danial author of Cryptocurrency Investing For Dummies is an award-winning internationally recognized personal investing and wealth management expert.

The global cryptocurrency market cap stood at Rs 21576 lakh crore a 059. There is also a speculative market for the coins on which the cryptocurrency is based. It is an autonomous high-performance low-cost cryptocurrency index fund.

Tax Settlement Offer in Compromise. Suppose a person buys shares from a company and pays 8000. The Investment Manager believes that cryptocurrency value and market share dynamics will be power law distributed meaning that a few cryptocurrencies.

Cost basis is the original value of an asset for tax purposes usually the purchase price adjusted for stock splits dividends and return of capital distributions. Development of the trading system is complete - CRYPTO20 offers value now not at some point in the future. The logos names and symbols appear in the first second and third column respectively.

Advantages of asset backed cryptocurrencies are that coins are stabilized by assets that fluctuate outside of the cryptocurrency space that is the underlying asset is not correlated reducing financial risk. Cryptocurrencys value stems from a combination of scarcity and the perception that it is a store of value an anonymous means of payment or a hedge against inflation. Bitcoin and altcoins are highly correlated so that cryptocurrency holders cannot escape widespread price falls without exiting the market or taking refuge in asset.

Any investment in blockchain assets involves the risk of loss of part or all of your investment. When you dispose of it you incur a capital gains tax event. If you are mining cryptocurrency as a hobby your tokens are considered a new asset with a cost basis of 0.

The amount included in income is the fair market value of the cryptocurrency when you received it. The live rCryptoCurrency Moons price today is 0154004 USD with a 24-hour trading volume of not available. Not considered legal tender Cryptocurrency exchanges.

The current CoinMarketCap ranking is 6939 with a live market cap of not available. Advanced Cryptocurrency Knowledge to ask any questions regarding cryptos. Plus this same market value will also serve as the cost basis for the new token that you receive from the ICO which you can use to calculate pooled costs.

If the value of an estate is large enough to qualify for federal estate taxes then the included stocks will be taxed as part of the overall value of. But it rose in value to 64000 as of the persons death date. Suppose that you sold one Bitcoin to acquire the equivalent value in Litecoin.

Bitcoin is a decentralized cryptocurrency originally described in a 2008 whitepaper by a person or group of people using the alias Satoshi NakamotoIt was launched soon after in January 2009. Bitcoin is a peer-to-peer online currency meaning that all transactions happen directly between equal independent network participants without the need for any intermediary to. For example 6500 plus a 149 transaction fee of 9685 divided by 144or 4588 per LTC.

You can also join our Facebook group at Master The Crypto. How is cryptocurrency gifts taxed. Determining valuation basis for estate taxes.

Similarly blockchain assets you exchange on the basis of your research may increase in value after your exchange. The net increase in value of the gift is the FMV of the gift less the donors adjusted basis. The value of cryptocurrency depends entirely on the demand in the crypto marketcryptocurrency units have no intrinsic value.

Cryptocurrency prices continued to be in the red on November 10. Cryptocurrencies allow users to transfer money instantly. Dollars plus any fees.

Diversification to the top 20 cryptocurrencies is now possible by holding a single token. Cryptocurrency Prices To make things easier this page displays the logos and the symbols beside the name of the cryptocurrency it is therefore impossible to make a mistake when looking at the numbers. She is a highly sought-after professional speaker author and executive coach who delivers inspirational workshops and seminars to corporations universities and entrepreneurial groups.

Learn How To Read Crypto Charts Ultimate Guide

How To Read Crypto Charts Beginner S Guide

/dotdash_Final_Why_Do_Bitcoins_Have_Value_Apr_2020-01-0a8036d672c34d69bd2f4f5175b754bb.jpg)

Why Do Bitcoins Have Value Bitcoin Explained

Cryptocurrency Price Fluctuation In Market

Bat Price Prediction For 2021 2022 2023 2025 2030

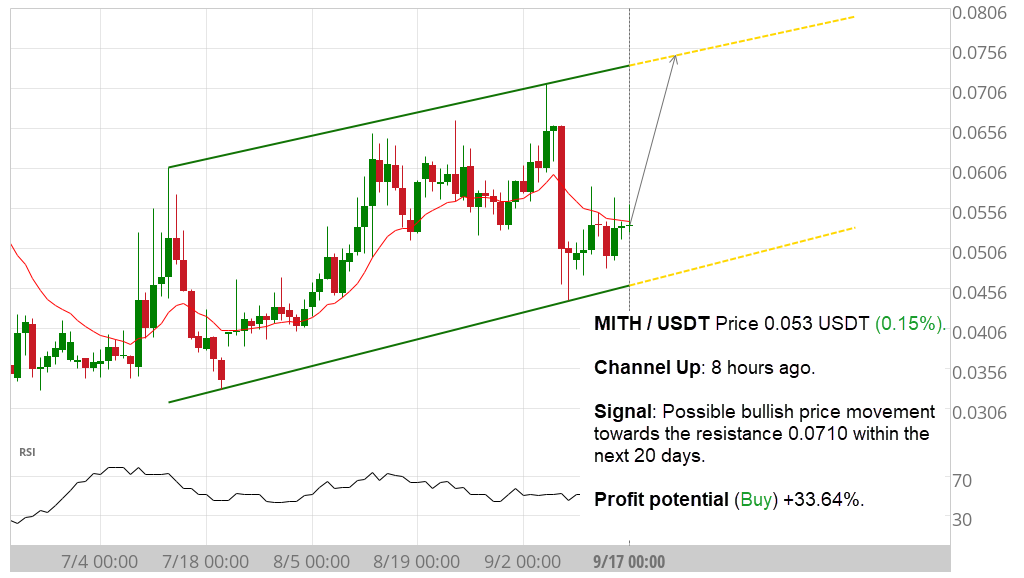

Crypto Chart Patterns Automated Signals

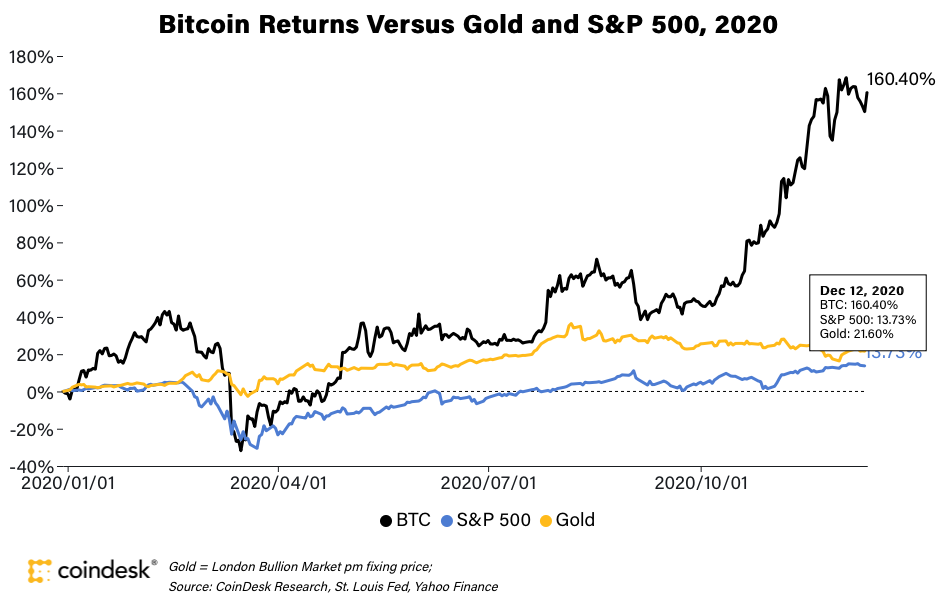

Bitcoin Prices In 2020 Here S What Happened Coindesk

.png)

How To Trade Bitcoin Learn About Bitcoin Trading

How To Value Bitcoin And Other Cryptocurrencies

Which Cost Basis For Your Crypto Tax Fifo Vs Lifo Vs Hifo Koinly

Faq How To Calculate Price Of Cryptocurrency Coin360

Bitcoin And Crypto Technical Analysis For Beginners

Cryptocurrency Accounting Guide How Do I Calculate My Crypto Gains Fintech Weekly

The Basic Cryptocurrency Architecture Source Blockgeeks Com Download Scientific Diagram

What Drives The Value Of Crypto Raconteur

/dotdash_INV-final-How-are-Bitcoin-Futures-Priced-2021-01-ec1b7bc0f95d4789b045ecb8b4dfc7a7.jpg)

How Are Bitcoin Futures Priced

Cryptocurrency Market 2021 26 Industry Share Size Growth Mordor Intelligence